403b early withdrawal calculator

The crucial questions you need to ask to help you decide. Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions.

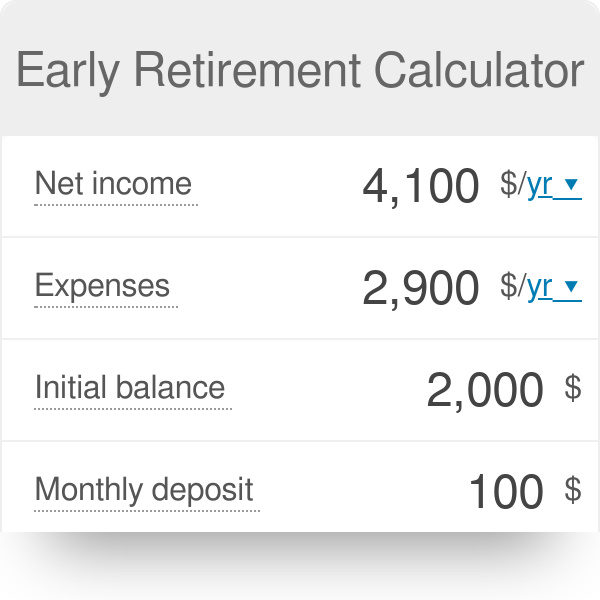

Early Retirement Calculator

In a 401 k calculator in the.

. Cashing out your 403b before you reach 59 12 typically. Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash. If they allow partial distributions the withdrawals will be taxable but he wont have to pay an early withdrawal penalty.

Visit the redesigned Investment Finder to browse pre-defined categories and compare with advanced filtering. Or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. On average your retirement accounts grow conservatively 4 a year.

I quit a full-time job in late 2018 and started a part-time job with a new organization in early 2019. Employers can choose to match contributions up to a certain amount. It is a CD Type of Annuity that pays 400 for 3 years.

IRS requirements restrict this type of withdrawal and may limit the amount you can withdraw. 403b plans are only available for employees of certain non-profit tax-exempt organizations. So for example if you cash out 10000 from your 401k and youre in the 22 percent federal tax bracket youll pay a total of 3200 in.

Read More about Middle School Students Explore Careers in Medicine at Camp Care. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k. Yes you should get the match first and then contribute to the 403b.

After 90 days standard withdrawal eligibility applies. Mortgage calculator with extra payments. When you cash out your 401k before the age of 59 ½ youll be required to pay income tax on the full balance as well as a 10 percent early withdrawal penalty and any relevant state income tax.

Angela Rozmyn who writes Tread Lightly Retire early was able to negotiate a reduction in work hours with her employer of many years. Should you pay off your mortgage early or invest. Learn more Responsible investing.

4 ways to help you extend your savings Here are some top strategies for withdrawing your retirement funds from three planning experts. The safe withdrawal rate in retirement is 4 a year 40000. A fixed annuity or MYGA may be suitable for conservative investors who are looking for a safe and steady way to grow their retirement savings.

April 10 2018 at 538 pm. As mentioned qualified distributions are tax-free. Calculate your earnings and more.

Whether you continue to work or not its quite likely youll hit that 10 Million mark. Use our 401k Early Withdrawal Costs Calculator first. Join the 1 Early Retirement and Financial Independence Forum Today - Its Totally Free.

Set aside a few evenings and read the 27-part ongoing series on safe withdrawal rates at Early Retirement Now. A 403b is a tax-advantaged retirement plan offered by specific schools and nonprofits. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax.

For early withdrawal we may impose a penalty of 90 days dividends on certificates of less than one year and 180 days dividends on certificates of one year or. The Guggenheim Life and Annuity Preserve MYGA 3 is a 3 year fixed annuity designed to be a high-yield retirement savings account. Automatic Enrollment Withdrawal New employees automatically enrolled in DCP have up to 90 days after their first paycheck deferral to cancel DCP and withdraw any contributions.

It may be tempting to pull money out of your 401k to cover a financial gap. The median outcome of using a 4 withdrawal rate over 30 years is to end up with 27x the amount of money you started with. In addition your account has to have been open for a minimum of five years.

Required Minimum Distributions Calculator. 403b Early Withdrawal Penalties. Mortgage calculator with taxes and insurance.

Since Social Security benefits are not always sufficient to keep up the living standard you are used to during your post-income-earning stage of life you may decide to. I have a 403b at work that has a Fixed rate of 7 and I just started contributing the full amount allowed per year. How to withdraw money from a retirement account.

7 min read Sep 06 2022. Early Withdrawal Calculator See all tools Explore TIAAs investment options. Review exceptions to the 10 additional tax on early retirement plan distributions.

But do you know the true cost. In Topic 558 the IRS describes early distributions as money you receive from qualified retirement plans before you are 59 12 years old. To count as a qualified distribution you have to be at least 595 when withdrawing money from your account.

501c3 Corps including colleges universities schools hospitals. Like 401a and 401k plans employees can contribute with pre-tax dollars. Once you reach Coast FI you may not need to work all year round.

Some fields are incomplete or the information is incorrect. QRP such as a 401k 403b or governmental 457b. See Age 55 No-Penalty Withdrawals From 401k Plan.

If you are specifically interested in a 403b retirement plan check our 403b calculator.

12 Ways To Avoid The Ira Early Withdrawal Penalty

403b Calculator

Retirement Withdrawal Calculator

401k Calculator

The Pros And Cons Of Borrowing From Your Retirement Plan Equitable

What S The Difference Between 401 A And 403 B Plans

Zt9cc6smpxtdm

Retirement Withdrawal Calculator For Excel

6urtk3 Mwgsfsm

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Financial Calculators

Cares Act 401k Withdrawal Edward Jones

Withdrawing Money From An Annuity How To Avoid Penalties

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

The Cost Of Cashing Out Retirement Plans Early Equitable

Withdrawing Money From An Annuity How To Avoid Penalties

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account